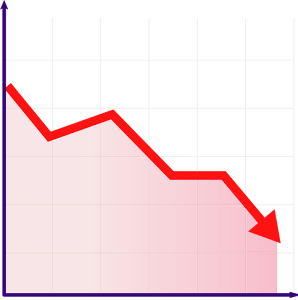

The financial exchange can go down for different reasons. A few normal elements include:

Financial Information:

- Negative financial reports, for example, unfortunate work numbers, declining Gross domestic product development, or debilitating buyer certainty can make financial backers stress over the condition of the economy, prompting an auction.

International Strains:

- Occasions like contentions, exchange questions, or political shakiness can create vulnerability in the business sectors, making financial backers sell stocks and look for more secure resources.

Corporate Income:

- If organizations report lower-than-anticipated income or give skeptical direction to future benefits, financial backers might sell their portions, making the general market decline.

Loan costs:

- Changes in loan fees set by national banks can influence costs for organizations and buyers, affecting spending and venture choices, which can influence stock costs.

Market Opinion:

- The financial backer's feeling can assume a critical part in market developments. On the off chance that financial backers become unfortunate or skeptical about the future viewpoint, they might sell stocks as a group, prompting a market slump.

What is the reason for stock market down?

The stock market can go down for many reasons. Despite this, here are some common factors that can cause the stock market to go down:

1. Rates of interest: Changes in loan fees by national banks can affect acquiring costs, purchaser spending, and business ventures, impacting stock costs.

2. Mood in the Market: Market movements can be influenced by investor sentiment, which is influenced by uncertainty, optimism, or fear. Negative opinions can prompt inescapable selling and market slumps.

3. Specialized Elements: Specialized pointers and exchanging examples might set off selling or benefit-taking among dealers, adding to transient market declines.

4. Worldwide Occasions: Occasions like cataclysmic events, pandemics, or unforeseen approach shifts in significant economies can annoy monetary business sectors and prompt stock costs to fall.

5. Economic Signals: Investors may become alarmed and experience selling pressure as a result of releases of negative economic data, such as a decrease in manufacturing activity, weak employment numbers, or a slowdown in GDP growth.

6. International Occasions: Vulnerability coming from international strains, for example, clashes, exchange questions, or political precariousness, can make financial backers become risk-opposed and sell stocks.

7. Corporate Income: Investors' confidence can be eroded and they may sell off stocks if major companies issue disappointing earnings reports or lower profit forecasts.

6. International Occasions: Vulnerability coming from international strains, for example, clashes, exchange questions, or political precariousness, can make financial backers become risk-opposed and sell stocks.

7. Corporate Income: Investors' confidence can be eroded and they may sell off stocks if major companies issue disappointing earnings reports or lower profit forecasts.

It's memorable pivotal that the securities exchange is impacted by a horde of elements, and its developments can be unusual temporarily. Furthermore, market slumps are a typical piece of the money management cycle, and financial backers ought to zero in on their drawn-out monetary objectives as opposed to transient changes.

Why is stock market crashing?

- Financial Downturn: A downturn, portrayed by a critical decrease in monetary movement, can prompt discounted customer spending, lower corporate benefits, and expanded joblessness, all of which can weigh vigorously on stock costs.

- Monetary Emergencies: Monetary emergencies, for example, banking breakdowns or credit crunches, can cause boundless frenzy and vulnerability in monetary business sectors, prompting sharp decreases in stock costs.

- Speculative Bubbles: Speculation and investor enthusiasm cause asset prices to rise beyond their ability to sustain them. When bubbles burst, prices can fall rapidly, causing a market crash.

- Worldwide Occasions: International strains, cataclysmic events, pandemics, or startling political improvements can upset monetary business sectors and cause financial backer frenzy, prompting a market slump.

- Loan fee Changes: Huge changes in loan costs, especially assuming they are startling or outrageous, can affect acquiring costs, shopper spending, and corporate benefits, which thusly can influence stock costs.

- Overvaluation: When stocks become essentially exaggerated compared with their basic essentials, for example, profit or development prospects, a remedy might happen, prompting a market slump as costs conform to additional healthy levels.

Will stocks recover in 2024

Anticipating the specific direction of the securities exchange for a particular year, for example, 2024, is trying because of the large number of elements that impact market developments. Nonetheless, a few elements can add to a potential financial exchange recuperation:

- Economic Growth: Stock market performance can be significantly influenced by the pace of economic recovery and growth. Positive financial pointers, for example, Gross domestic product development, shopper spending, and business venture can reinforce financial backer certainty and back a recuperation in stock costs.

- Corporate Profit: Solid corporate income is pivotal for driving financial exchange execution. On the off chance that organizations report powerful income and give hopeful direction to (future benefits), it could add to a bounce back in stock costs.

- Financial Approach: National bank strategies, including loan fee choices and money-related improvement measures, can impact market opinion and liquidity conditions. Stock markets may benefit from accommodating monetary policies that support economic growth.

- Monetary Arrangement: Government financial strategies, for example, improvement bundles, framework spending, and assessment approaches, can affect financial development and financial backer feelings. Financial measures pointed toward animating monetary movement might uphold a recuperation in stock costs.

- Market Opinion: Financial backer feeling assumes a huge part in market developments. Investor confidence can be boosted and the stock market can recover thanks to positive news about economic indicators, corporate earnings, or geopolitical developments.

- Mechanical Development: Advances in innovation and development can drive development in specific areas of the economy, possibly prompting open doors for financial exchange recuperation.

While these variables can add to a potential financial exchange recuperation in 2024, it's fundamental to perceive that putting resources into the financial exchange implies intrinsic dangers, and past execution isn't characteristic of future outcomes. Financial backers ought to keep an enhanced portfolio lined up with their drawn-out monetary objectives and be ready for potential market unpredictability. Talking with a monetary counselor can give customized direction in view of individual conditions and change resilience.

FAQ (frequently asked questions)

1. Why Does The Stock Market Fall?- There can be many reasons for the decline in the stock market.

2. Should you invest in the stock market?

- If you want to invest in the stock market, it depends on you. Because it is risky and profitable. If you are ready to take risk then you can invest in the stock market.

- Yes, there is a future in the stock market. But there is risk in this also.

To be published, comments must be reviewed by the administrator.