you are a resident of California. And you are looking for a good insurance company for your car in California.

So today I will tell and talk with you about some car insurance companies in California. Which will be very helpful for you.

Car insurance is very beneficial, it is very important to have it as it meets the legal requirements, protects your car, and also protects you and other people. And economic security etc.

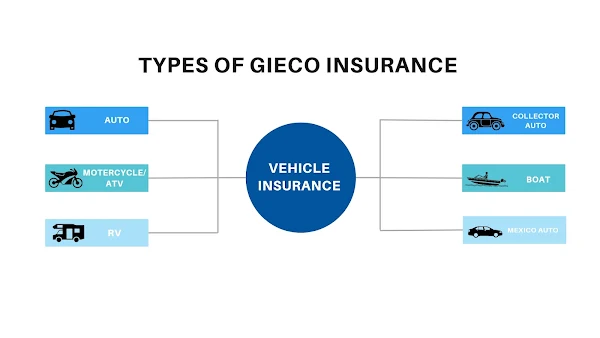

Let's talk about car insurance companies in California. Geico is a very famous company.

Geico is a very famous company.

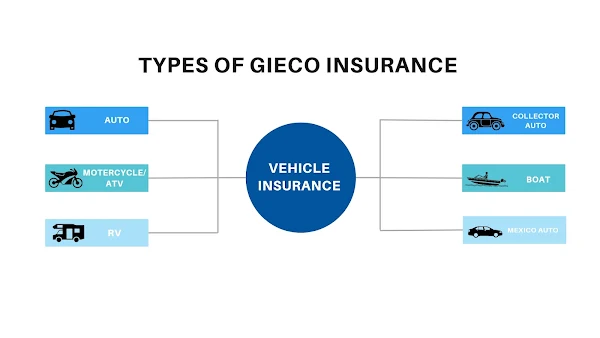

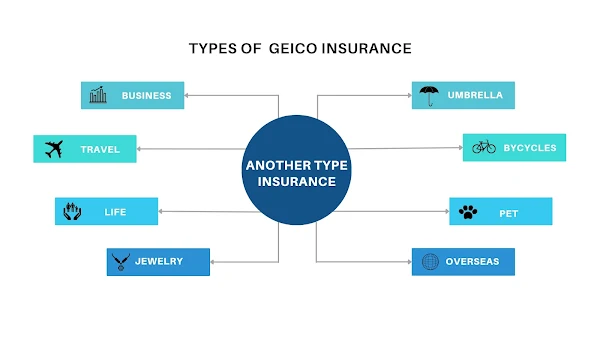

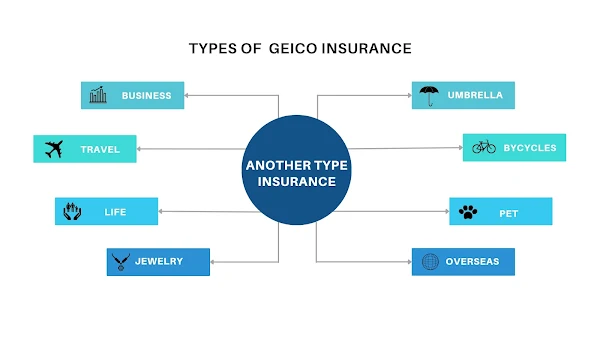

Geico Insurance Company offers many types of insurance.

State Farm is America's largest in

State Farm is America's largest in

So that every person can remain protected.

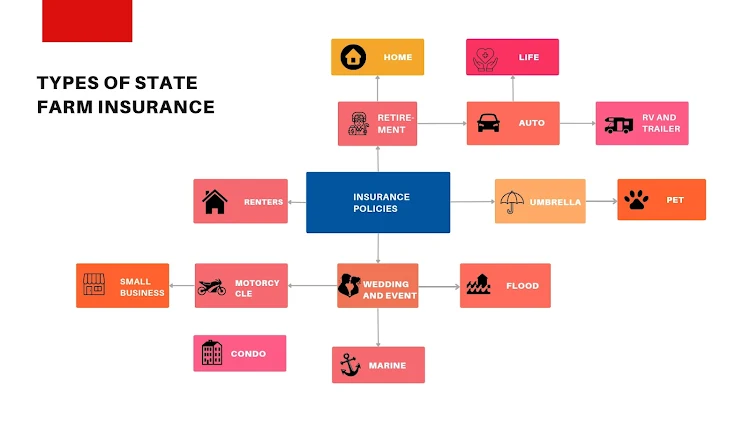

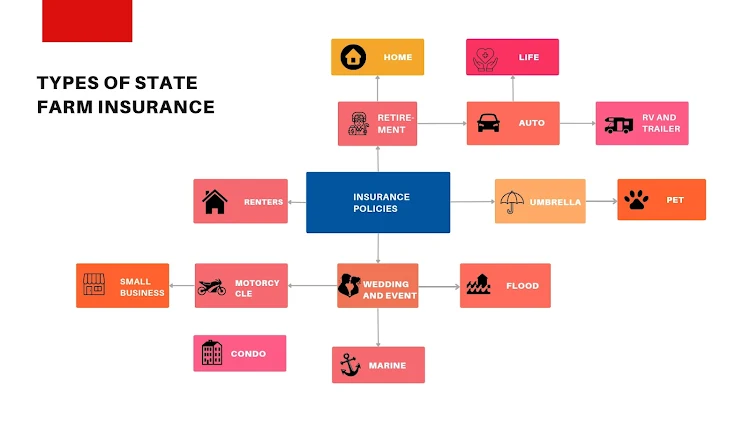

State Farm offers a variety of insurance:

You can learn about other insurances on the State Farm website.

You can learn about other insurances on the State Farm website.

State Farm is quite popular for its quality and good customer service. State Farm has created its own identity among the people due to which the customers of State Farm trust State Farm a lot.

You can get answers to your questions and get more information from the State Farm Company helpline number and you can get answers to all the questions related to insurance for free.

State Farm has a very famous tagline, you might have also heard, Like a good neighbor, State Farm is there, which State Farm represents to its customers that like a good neighbor, State Farm is standing shoulder to shoulder with you. Similarly, State Farm is also available to assist you at all times. Which gives confidence to its customers.

State Farm also provides an online chat service to its customers through which you can get instant answers to your questions through online chat and get online solutions to any insurance-related problem.

You can learn more about your insurance through our mobile app. You can know information about insurance claim policy. You can update your insurance policy through your mobile app. State Farm provides its customers with a digital insurance ID card through which they can verify their insurance by showing the ID card.

Personal information is also important in this such as:

Car Owner Name' Driving License' Date of Birth' Address' Contact Number'

2. Click on Start a Quote below

2. Click on Start a Quote below

Progressive provides mobile apps and online tools to its customers to manage their insurance policies easily and without any hassle so that customers can manage their policies from home without any long hassle.

Progressive provides mobile apps and online tools to its customers to manage their insurance policies easily and without any hassle so that customers can manage their policies from home without any long hassle.

Progressive also offers discounts on many policies to help customers save money. Due to this customers can also avail of insurance as per their need from their savings.

Progressive provides its customers with an online tool (Name Your Price Tool) through which customers can make further progress in their insurance policy by providing information about their vehicle and coverage through this tool. This tool generates a quotation based on the information provided by the customer.

2. Create a Progressive Account: If you have already created a Progressive Account then login and log in to your account.

2. Create a Progressive Account: If you have already created a Progressive Account then login and log in to your account.

3. Select the Car Insurance option and tap on it.

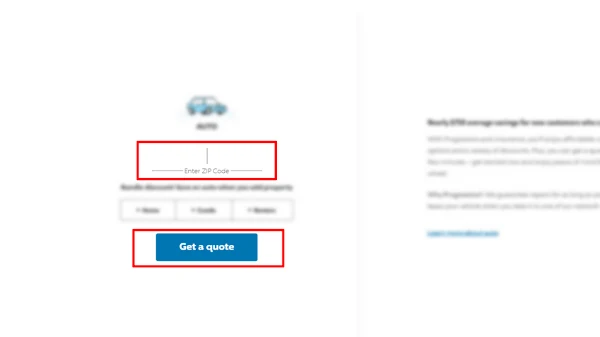

4. You will get a few options to choose from in which you will get the option to start a quote and you will get the option to fill in the zip code of your area. And along with this you also get the option to call and find an agent, from which you can get more information.

And along with this you also get the option to call and find an agent, from which you can get more information.

5. After starting the quotation, in the next step you will have to fill in your full name and date of birth and then proceed further.

6. After proceeding, the next page will open in which you will have to fill in your address, street name, state, and city and then click on the Ok Start A Quote option given below.

7. After which you will be asked for information about you and your car, you will have to fill in all that information.

8. It may ask you to complete all the questions required in the document like some of your documents like driving license, driving history, etc. Driving History, complete all questions required on your document.

9. Choose Coverage Choose what coverage you want from your policy.

10. Confirm the policy: Once you have given all the details, confirm your policy and that all the information you have given is correct, including your car information and coverage.

11. Make Payment After confirming your policy, make payment for your policy. On making online payment you will be given online payment details which may include debit card, credit card, and some other payment methods. You can pay for the policy by choosing the payment method at your convenience.

12. Download all policy documents

After payment, you will get your online policy documents which you can download, print, and keep with you.

Allstate is a very large and well-known insurance company. Which is known for its special experience.

Allstate is a very large and well-known insurance company. Which is known for its special experience.

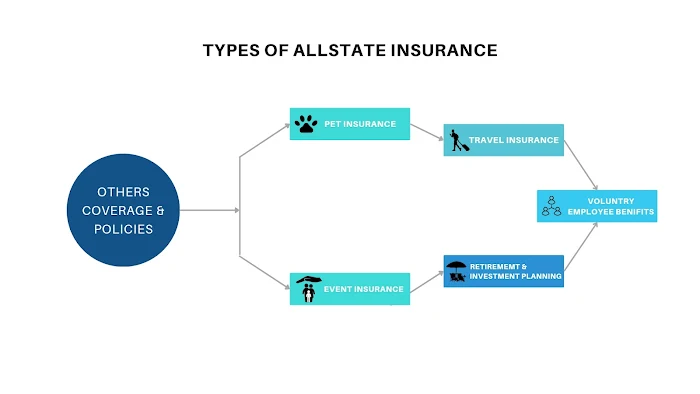

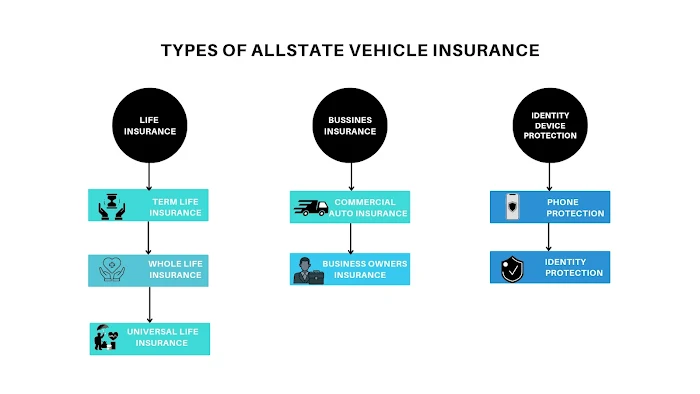

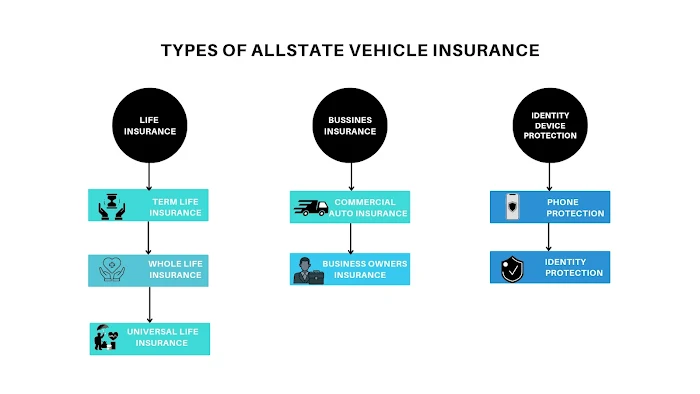

Allstate offers different types of insurance.

Vehicle Insurance

Allstate makes its customers feel that they will be there for them in case of loss or any problem they face.

Allstate offers discounts to its customers so customers can save money. And you can get insurance as per your need with less savings. This discount can be of different types. While buying insurance you must look for discount offers.

Allstate offers 24/7 customer support to its customers. Allstate is always available to assist its customers. So that their customers can get more service.

Allstate offers online services in which customers can buy and manage their policies online and as per the online website, customers can avail claim settlement and other insurance services right from the comfort of their home.

1. Allstate Website:

Click on Allstate's official website. 2. Login to your account with Allstate:

2. Login to your account with Allstate:

Log in to your account with Allstate. If you have already created an account with Allstate, log in. If not, you will need to create a new account.

3. Select Insurance:

Select the insurance you need insurance for. For example car auto insurance.

4. Local Area Agent:

After which you will have to fill in the zip code of your area for car insurance. After which you will find an Allstate agent in your local area. You will be given the contact details of the agent in your nearby area which you should note down. 5. Meet The Agent:

5. Meet The Agent:

Contact the agent and talk to the agent about your insurance.

6. The Agent Will Guide You:

The agent will give you complete information about car insurance and tell you what documents will be required and what needs to be done.

7. Talk To The Agent About Discount Offers:

Talk to the agent about discount offers so you can get more information about what discounts you will get if you are going to purchase insurance.

8. Understand Insurance Documents:

To understand what documents are required to get your insurance, ask the agent about the insurance documents.

9. Customize The Policy:

Customize your policy by telling the agent what coverage is required in your insurance policy, what type of policy you want, and what coverages you want to add to your policy.

10. Apply For The Policy:

If you agree with your insurance policy and you want to buy your insurance policy then submit your policy application to the agent.

While applying you will have to provide information about yourself and your vehicle.

11. Policy Payment Schedule:

After applying for the policy you will need to pay for the policy, please speak to the agent about policy payment and make the payment in whichever way suits you.

12. Get The Policy Documents:

Once your application is approved the agent gives you your policy document which contains your policy number. Whatever documents your agent gives you, keep them under control.

Let's talk about the star rating of the insurance company which I have given through photos. These insurance companies are very interested in providing high convenience to their customers. If you live in California and need car insurance or any other type of insurance then you can choose any of these insurance companies and get yourself insured. Are. I have told you all the steps you should follow to get insurance.

Let's talk about the star rating of the insurance company which I have given through photos. These insurance companies are very interested in providing high convenience to their customers. If you live in California and need car insurance or any other type of insurance then you can choose any of these insurance companies and get yourself insured. Are. I have told you all the steps you should follow to get insurance.

#1.Geico (government employees Insurance Company)

Geico Insurance Company offers many types of insurance.

Vehicle insurance

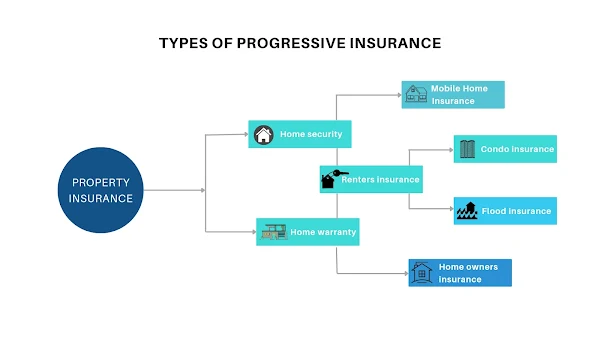

Property Insurance

Business Insurance

Geico provides different types of insurance which the insured person can choose according to his need.

Geico company is known for its better services. Geico Insurance Company also provides online insurance services to its customers. And eases the process of buying an online insurance policy so that individuals can buy insurance simply sitting at home. And can avail better services.

Geico offers great discounts and user discounts to its customers. Which proves to be very beneficial for insurance customers.

Geico is a trusted large insurance company in America that provides the highest level of convenience and support to its customers. Geico listens carefully to customer issues or needs and provides the highest level of assistance through its dedicated customer service team. Due to this, Geico insurance customers do not have to face any insurance problems.

Important

(You don't need to take car insurance, you can choose any insurance as per your choice.)

Some important steps to follow to get Geico Car Auto Insurance

Car Owner Details: Name\Date of Birth\Address\Driving License

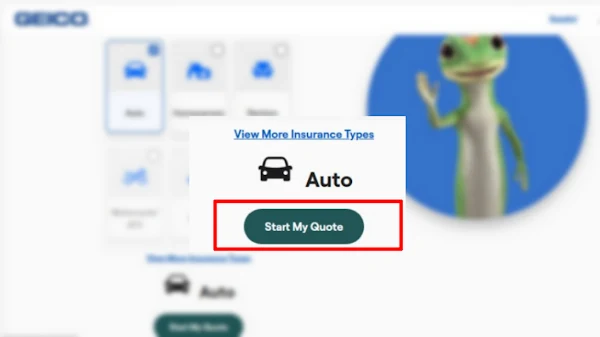

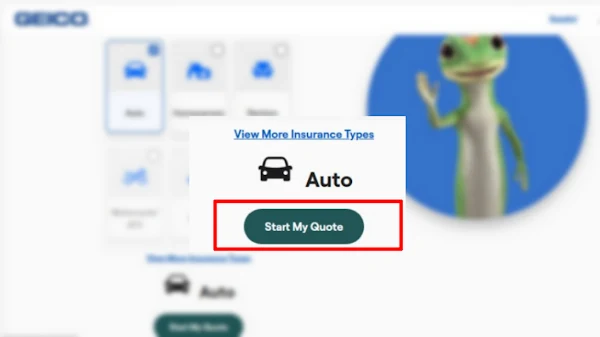

1. Go to the official website of Geico with the help of a browser.

Geico offers great discounts and user discounts to its customers. Which proves to be very beneficial for insurance customers.

Geico is a trusted large insurance company in America that provides the highest level of convenience and support to its customers. Geico listens carefully to customer issues or needs and provides the highest level of assistance through its dedicated customer service team. Due to this, Geico insurance customers do not have to face any insurance problems.

What to do to get car insurance at Geico?

What do you need to do if you want to take an insurance policy from GEICO company for car auto insurance?Important

(You don't need to take car insurance, you can choose any insurance as per your choice.)

Some important steps to follow to get Geico Car Auto Insurance

1. Collect Car Information

The number of the car you want to insure, car registration number, car model number.Car Owner Details: Name\Date of Birth\Address\Driving License

2. Insurance Coverage

Insurance Coverage Choose what type of insurance coverage you want. For example some coverage:-- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Roadside Assistance

3. Collect Documents

You may need a few documents to get Geico car insurance.- Driving License

- Driving History

- Place Of Residence

- Certificate Of Income

4. Apply Online

Apply for Geico car insurance online from the comfort of your home. And get an insurance policy sitting at home1. Go to the official website of Geico with the help of a browser.

2. After entering the Geico website you will get many insurance options to choose from, choose the insurance option as per your requirement.

3. After choosing the insurance option, you will get the option of Start Quota below, click on it click on the Continue button, and proceed further.

4. If you choose car insurance then you need to provide car information such as your car registration number, car model number, and any other documents. You also have to provide some personal information like your name, date of birth, and driving history.

5. Choose coverage Choose Insurance Coverage What coverage do you want in your policy? You can choose them as per your needs.

6. After the information given by you, Geico will make an insurance policy for you. In which there will be information about coverage, policy payment, etc.

7. Know the terms and conditions Every company's policy has its own terms and conditions which the customer has to follow. Know the terms and conditions of your policy and see what coverage is included in your insurance policy.

8. Pay the premium online only if you agree with the policy you have chosen. And you want to buy it online. For this, you can pay online through credit and debit cards and other payment methods.

9. After making the online payment for the insurance policy, you will receive your policy which will have all the information about your policy and what coverage you will get under your policy. And in case of an accident, you need to have the policy to claim the policy.

It's important to know the rules of car insurance and what coverage it includes. And how can you apply for coverage and policy claims? Contact Geico and learn more. It is very important to know the valid details of your insurance and get it renewed from time to time.

8. Pay the premium online only if you agree with the policy you have chosen. And you want to buy it online. For this, you can pay online through credit and debit cards and other payment methods.

9. After making the online payment for the insurance policy, you will receive your policy which will have all the information about your policy and what coverage you will get under your policy. And in case of an accident, you need to have the policy to claim the policy.

5. Rules and Regulations of Insurance

It is very important to follow car insurance rules.It's important to know the rules of car insurance and what coverage it includes. And how can you apply for coverage and policy claims? Contact Geico and learn more. It is very important to know the valid details of your insurance and get it renewed from time to time.

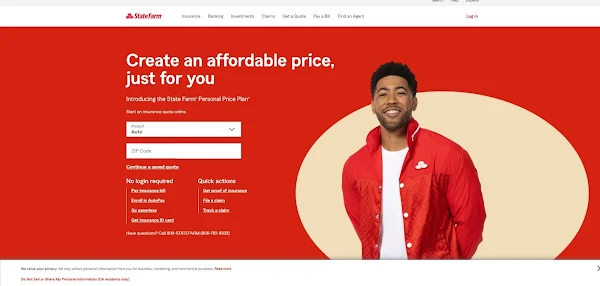

#2. State Farm Mutual Automobile Insurance Company

State Farm is America's largest in

State Farm is America's largest inSo that every person can remain protected.

State Farm offers a variety of insurance:

State Farm is quite popular for its quality and good customer service. State Farm has created its own identity among the people due to which the customers of State Farm trust State Farm a lot.

You can get answers to your questions and get more information from the State Farm Company helpline number and you can get answers to all the questions related to insurance for free.

State Farm has a very famous tagline, you might have also heard, Like a good neighbor, State Farm is there, which State Farm represents to its customers that like a good neighbor, State Farm is standing shoulder to shoulder with you. Similarly, State Farm is also available to assist you at all times. Which gives confidence to its customers.

State Farm also provides an online chat service to its customers through which you can get instant answers to your questions through online chat and get online solutions to any insurance-related problem.

You can learn more about your insurance through our mobile app. You can know information about insurance claim policy. You can update your insurance policy through your mobile app. State Farm provides its customers with a digital insurance ID card through which they can verify their insurance by showing the ID card.

What To Do To Get State Farm Car Insurance

1. Coverage Choose

It is very important to choose car insurance coverage first. Car Insurance Coverage Liability Insurance Collision Coverage. Any coverage can be chosen, you can choose the coverage as per your requirement. Before taking insurance, once you have collected all the information about the car.2. Collect All Car Information

For car insurance, you need to know the detailed information of the car like car number, registration number, car model, and all other information about the car.Personal information is also important in this such as:

Car Owner Name' Driving License' Date of Birth' Address' Contact Number'

3. Apply Online

1. Go to the official website of State Farm and select Car Insurance.

3. Enter your car information. Car registration number, and car owner details.

4. Discounts: This is very important. State Farm offers many insurance discounts. You must check the discount offers before purchasing the insurance.

5. Choose Coverage Choose the coverage you want in your car insurance.

6. Before submitting your application, confirm your policy once to ensure that all the information entered by you is correct, the policy car information you chose, and your own information coverage.

7. Confirm your quotation.

After booking your application, confirm if everything is correct?

And move into the next phase of the policy.

8. To purchase the policy you can make the payment online through the given payment methods which include debit card, credit card, and any other payment method available to you. You can make payment as per your account and as per your convenience.

9. Download a digital ID card and some documents: After purchasing the policy, you get a policy number, and you can download it online. You get the state form digital ID insurance card and some other documents that you can print. And you can keep it with you.

An American insurance company. This is quite famous. This company was started in 1907 by AT Vigneron, which is currently providing insurance to two people.

An American insurance company. This is quite famous. This company was started in 1907 by AT Vigneron, which is currently providing insurance to two people.

4. Discounts: This is very important. State Farm offers many insurance discounts. You must check the discount offers before purchasing the insurance.

5. Choose Coverage Choose the coverage you want in your car insurance.

6. Before submitting your application, confirm your policy once to ensure that all the information entered by you is correct, the policy car information you chose, and your own information coverage.

7. Confirm your quotation.

After booking your application, confirm if everything is correct?

And move into the next phase of the policy.

8. To purchase the policy you can make the payment online through the given payment methods which include debit card, credit card, and any other payment method available to you. You can make payment as per your account and as per your convenience.

9. Download a digital ID card and some documents: After purchasing the policy, you get a policy number, and you can download it online. You get the state form digital ID insurance card and some other documents that you can print. And you can keep it with you.

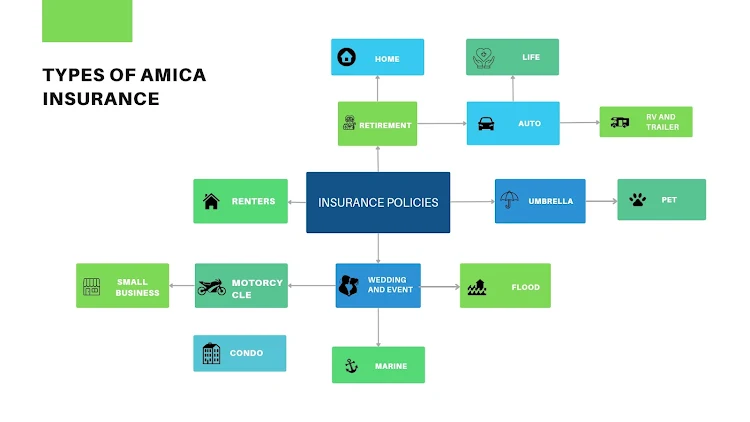

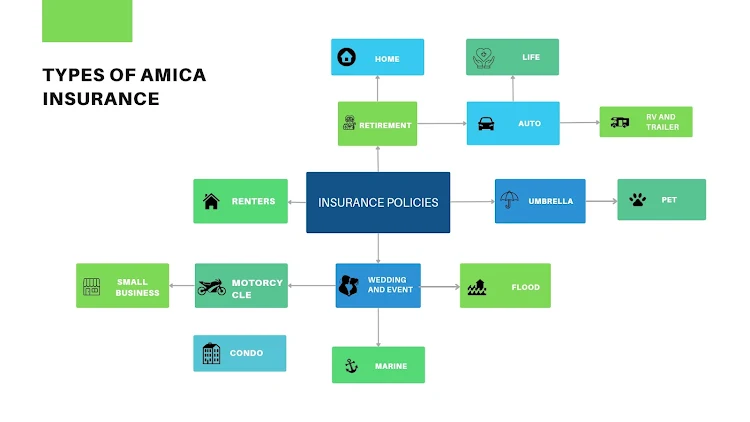

#3. Amica (Automobile Mutual Insurance Company of America)

Amica is a trustworthy company with its work which has won the hearts of people and has created its own identity among the people.

Amica offers a variety of insurance policies to protect its customers. And fulfills her promise.

Amica is well known for its customer service. This insurance company understands the needs of its customers very well. Always ready to help our customers. People like it very much and also trust it.

Amica company provides discount offers and various special benefits to its Amica customers so that people can save money. So if you want to take any insurance from Amica insurance company, then first check the discounts offered.

Amica offers different types of insurance such as home insurance, health insurance, car insurance, and business insurance.

Find an Amica agent in your local area who can help you obtain insurance.

2. Meet The Agent.

Contact the agent and talk to the agent about your insurance.

3. The agent Will Guide You.

The agent will give you complete information about car insurance and tell you what documents you will need to get car insurance and what needs to be done for it.

4. Talk To The Agent About Discount Offers.

Talk to the agent about discount offers so you can get more information about what discounts you will get when you purchase insurance.

5. Understand The Insurance Documents.

Understand from the agent about the insurance documents which documents you will need to get insurance.

6. Customize The Policy.

Customize your policy by telling the agent your insurance needs, what coverage you need in your insurance policy, what type of policy you want, and what coverage you want to add to your policy.

7. Apply For The Policy.

If you agree with your insurance policy and you want to buy your insurance policy then submit your policy application to the agent.

While applying you will have to fill in your and your vehicle's information.

8. Pay The Policy.

After applying for the policy you will need to pay for the policy, please speak to the agent about policy payment and make the payment in whichever way suits you.

9. Obtain The Policy Document.

Once your application is approved the agent gives you your policy document which contains your policy number. Whatever documents your agent gives you, keep them under control.

Progressive provides 24/7 service to its customers. This makes it easier for Progressive's customers to get solutions to their policy problems. Progressive gives complete satisfaction to its customers. It is always ready to help its customers.

Progressive provides 24/7 service to its customers. This makes it easier for Progressive's customers to get solutions to their policy problems. Progressive gives complete satisfaction to its customers. It is always ready to help its customers.

Amica is well known for its customer service. This insurance company understands the needs of its customers very well. Always ready to help our customers. People like it very much and also trust it.

Amica company provides discount offers and various special benefits to its Amica customers so that people can save money. So if you want to take any insurance from Amica insurance company, then first check the discounts offered.

Amica offers different types of insurance such as home insurance, health insurance, car insurance, and business insurance.

How To Get Amica Car Insurance?

1. Find an Amica Insurance Agent.Find an Amica agent in your local area who can help you obtain insurance.

2. Meet The Agent.

Contact the agent and talk to the agent about your insurance.

3. The agent Will Guide You.

The agent will give you complete information about car insurance and tell you what documents you will need to get car insurance and what needs to be done for it.

4. Talk To The Agent About Discount Offers.

Talk to the agent about discount offers so you can get more information about what discounts you will get when you purchase insurance.

5. Understand The Insurance Documents.

Understand from the agent about the insurance documents which documents you will need to get insurance.

6. Customize The Policy.

Customize your policy by telling the agent your insurance needs, what coverage you need in your insurance policy, what type of policy you want, and what coverage you want to add to your policy.

7. Apply For The Policy.

If you agree with your insurance policy and you want to buy your insurance policy then submit your policy application to the agent.

While applying you will have to fill in your and your vehicle's information.

8. Pay The Policy.

After applying for the policy you will need to pay for the policy, please speak to the agent about policy payment and make the payment in whichever way suits you.

9. Obtain The Policy Document.

Once your application is approved the agent gives you your policy document which contains your policy number. Whatever documents your agent gives you, keep them under control.

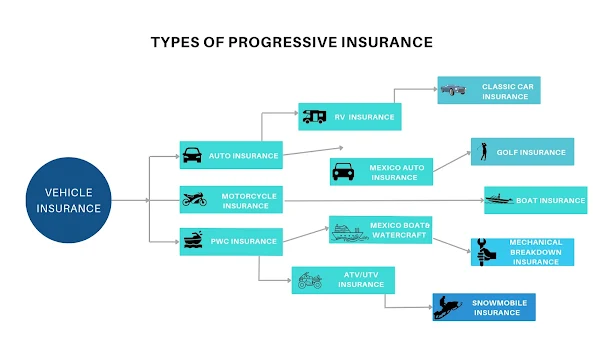

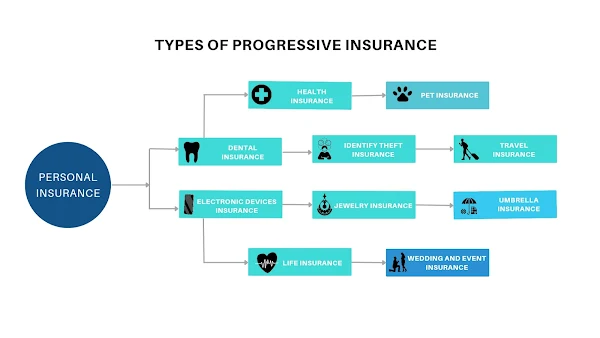

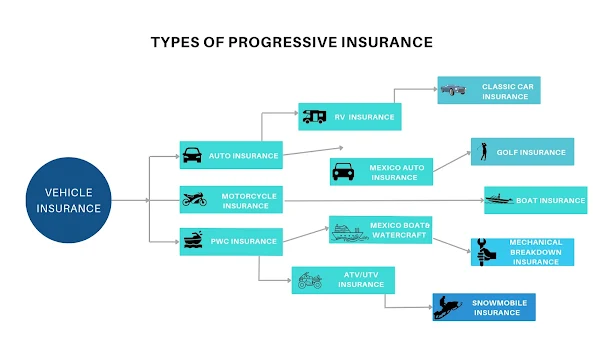

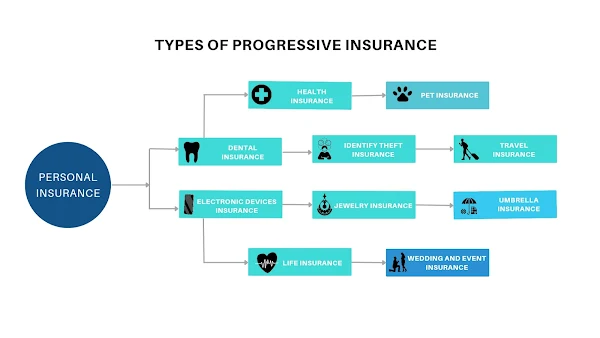

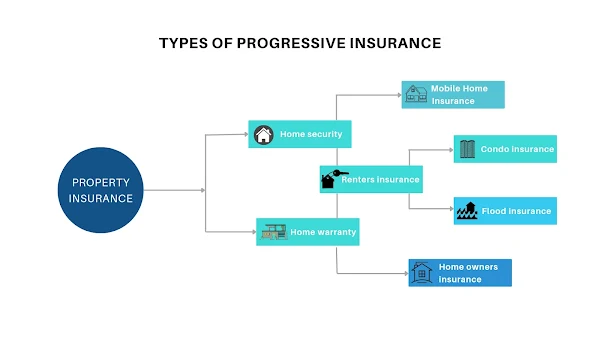

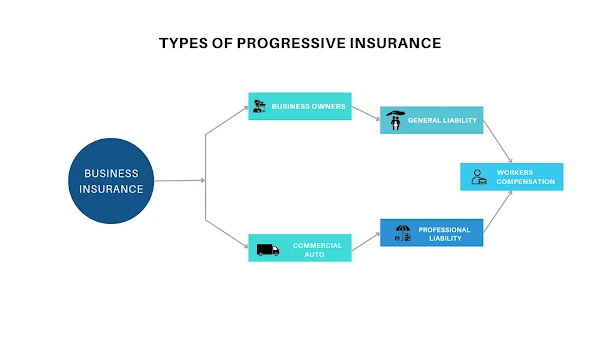

#4. Progressive

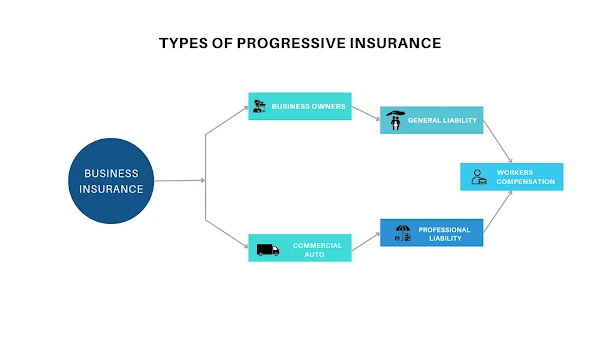

Progressive offers several types of insurance. Read below

Vehicle Insurance:

Personal Insurance:

Property Insurance:

Business Insurance:

Progressive provides mobile apps and online tools to its customers to manage their insurance policies easily and without any hassle so that customers can manage their policies from home without any long hassle.

Progressive provides mobile apps and online tools to its customers to manage their insurance policies easily and without any hassle so that customers can manage their policies from home without any long hassle.Progressive also offers discounts on many policies to help customers save money. Due to this customers can also avail of insurance as per their need from their savings.

Progressive provides its customers with an online tool (Name Your Price Tool) through which customers can make further progress in their insurance policy by providing information about their vehicle and coverage through this tool. This tool generates a quotation based on the information provided by the customer.

This tool provides the customers with the option to customize the budget through which the customer can purchase the policy by setting the budget of the insurance policy as per his requirement.

Vehicle owner information

car owner's name, dob, contact number, address, car owner's driving license.

How To Get Progressive Car Insurance?

Follow the given steps to get progressive car insurance.1. Collect Car Information

car number registration car model engine number chassis number.Vehicle owner information

car owner's name, dob, contact number, address, car owner's driving license.

2. Choose Coverage

Select all the coverages you need in your car insurance. Some famous coverage whose names this coverage is quite important.- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Roadside Assistance

3. Name Your Price Tool

Use Progressive's Name Your Price Tool. Through this, you can customize the policy according to your budget, set the price, and buy the policy.4. Options and Offers

Before taking progressive car insurance, be sure to know about the discount offers. Because Progressive continues to offer a variety of insurance discounts. You can save a lot if you take up the insurance on offer.5. Apply Online

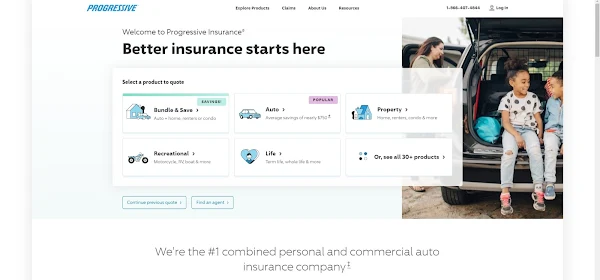

1. Visit the official website Progressive.

3. Select the Car Insurance option and tap on it.

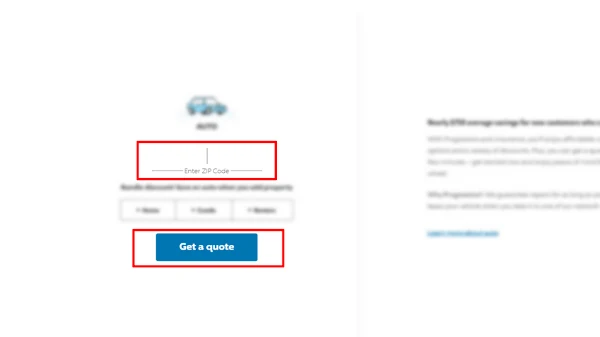

4. You will get a few options to choose from in which you will get the option to start a quote and you will get the option to fill in the zip code of your area.

5. After starting the quotation, in the next step you will have to fill in your full name and date of birth and then proceed further.

6. After proceeding, the next page will open in which you will have to fill in your address, street name, state, and city and then click on the Ok Start A Quote option given below.

7. After which you will be asked for information about you and your car, you will have to fill in all that information.

8. It may ask you to complete all the questions required in the document like some of your documents like driving license, driving history, etc. Driving History, complete all questions required on your document.

9. Choose Coverage Choose what coverage you want from your policy.

10. Confirm the policy: Once you have given all the details, confirm your policy and that all the information you have given is correct, including your car information and coverage.

11. Make Payment After confirming your policy, make payment for your policy. On making online payment you will be given online payment details which may include debit card, credit card, and some other payment methods. You can pay for the policy by choosing the payment method at your convenience.

12. Download all policy documents

After payment, you will get your online policy documents which you can download, print, and keep with you.

6. Know the terms and conditions of the policy:

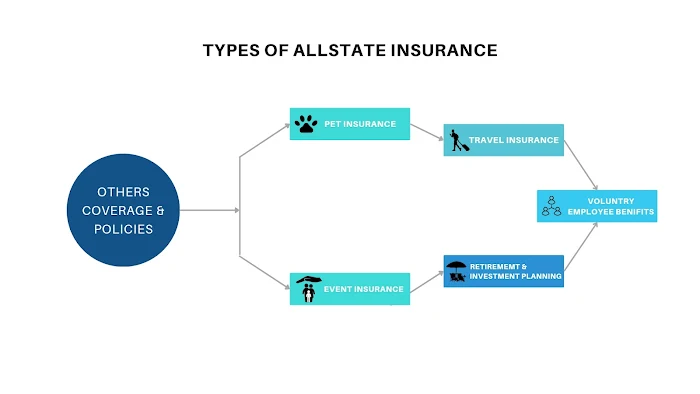

Every company has different terms and conditions depending on the terms and conditions of the insurance policy. Therefore, you should know the terms and conditions and know more about the policy, what is included in your policy, coverage, and claims#5. Allstate (Allstate Property and Casualty Insurance Company)

Allstate offers different types of insurance.

Vehicle Insurance

Property Insurance

Other Coverage & Policies

When it comes to car insurance, Allstate Car Insurance offers a variety of insurance coverage options to its customers. Provides protection to your car if your motor vehicle is damaged in any way, or is stolen, or against incidents such as any other type of natural vehicle damage.

- Liability Coverage

- Personal Injury Protection (PIP)

- Collision Coverage

- Comprehensive Coverage

Allstate makes its customers feel that they will be there for them in case of loss or any problem they face.

Allstate offers discounts to its customers so customers can save money. And you can get insurance as per your need with less savings. This discount can be of different types. While buying insurance you must look for discount offers.

Allstate offers 24/7 customer support to its customers. Allstate is always available to assist its customers. So that their customers can get more service.

Allstate offers online services in which customers can buy and manage their policies online and as per the online website, customers can avail claim settlement and other insurance services right from the comfort of their home.

What to pay for Allstate car insurance?

Let me tell you what you need to do to get Allstate car insurance.1. Allstate Website:

Click on Allstate's official website.

Log in to your account with Allstate. If you have already created an account with Allstate, log in. If not, you will need to create a new account.

3. Select Insurance:

Select the insurance you need insurance for. For example car auto insurance.

4. Local Area Agent:

After which you will have to fill in the zip code of your area for car insurance. After which you will find an Allstate agent in your local area. You will be given the contact details of the agent in your nearby area which you should note down.

Contact the agent and talk to the agent about your insurance.

6. The Agent Will Guide You:

The agent will give you complete information about car insurance and tell you what documents will be required and what needs to be done.

7. Talk To The Agent About Discount Offers:

Talk to the agent about discount offers so you can get more information about what discounts you will get if you are going to purchase insurance.

8. Understand Insurance Documents:

To understand what documents are required to get your insurance, ask the agent about the insurance documents.

9. Customize The Policy:

Customize your policy by telling the agent what coverage is required in your insurance policy, what type of policy you want, and what coverages you want to add to your policy.

10. Apply For The Policy:

If you agree with your insurance policy and you want to buy your insurance policy then submit your policy application to the agent.

While applying you will have to provide information about yourself and your vehicle.

11. Policy Payment Schedule:

After applying for the policy you will need to pay for the policy, please speak to the agent about policy payment and make the payment in whichever way suits you.

12. Get The Policy Documents:

Once your application is approved the agent gives you your policy document which contains your policy number. Whatever documents your agent gives you, keep them under control.

Star Rating Of Insurance Companies

Thanks for providing great article. I read your article very carefully. It's very helpful and useful.

ReplyDelete